There’s real money in the brands in your fund’s portfolio companies. It is time to look at brand value–and what drives it.

When your fund invests in a company, part of what you buy is the value of the brands that company brings to market. Yet not all brands are valuable—some actually destroy capital. All too often, companies waste marketing dollars on under-performing legacy brands that do not create value. Your funds’ managing members should take a hard look at these brand value inefficiencies:

Five ways brands destroy value

- Too many brands add costs. Are there too many brands competing for scarce resources? Do brands compete against each other for the same customer? Do they overlap, cannibalize, and create complexity?

- Too few brands miss opportunities. Do existing brands try to stand for too many things? Are salespeople struggling to explain products and services?

- Brand confusion makes selling harder. Is the sprawling hodgepodge of brands hard for the customer to understand? Is it difficult to bundle services or cross-sell?

- Brands are often kept beyond their ability to return profits. Companies accumulate brands through acquisitions and innovation. The impulse to name everything is very real. Brands are too often kept for sentimental, political, or anecdotal reasons, or through sheer inertia, without an understanding of a quantifiable business case for each.

- Brands fail to communicate company scope and value. Do investors and customers understand and appreciate the company in totality? Is it clear how the company brand, division, product, and service brands relate to one another? The result is an undervaluing the company as a whole.

The secret to doubling the value of portfolio companies

If your fund has invested in a company with too many of these brand value problems and too many excuses for not fixing them, you will want to act. There is real money to be saved and real money to be made.

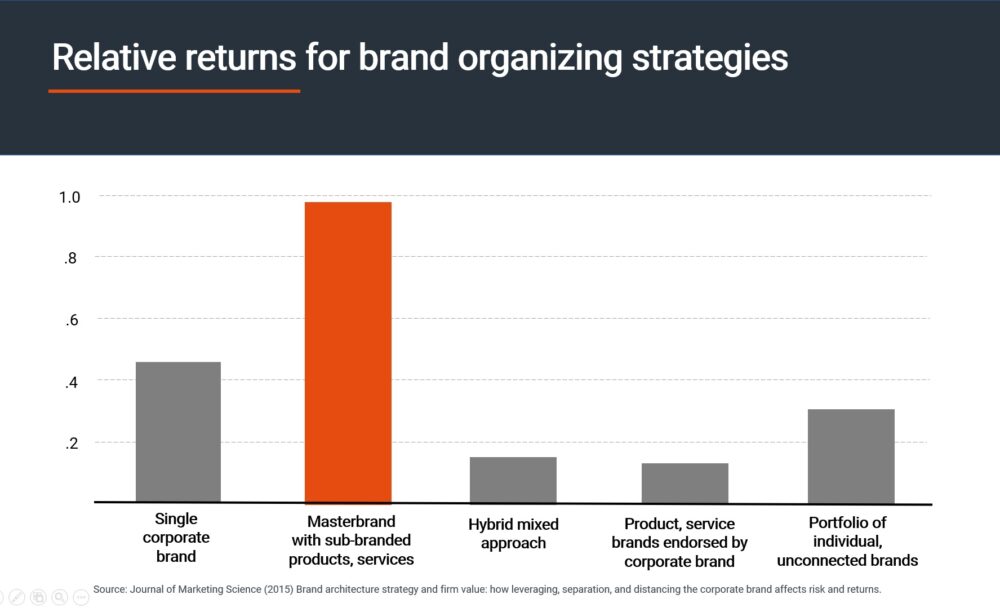

A recent study of over 500 B2C and B2B companies uncovered the brand organizing strategy that pays off the most in terms of brand value. The data show that the “masterbrand+sub-brand” strategy drives greater shareholder value when compared to the alternatives.

What you need to do to capture brand value:

- Push portfolio company management teams to identify and assess their brands.

- Retire those brands that are under performing.

- Consolidate brands so that you stop cannibalizing revenue streams

- Reallocate marketing spending on the remaining brands

- Consider creating a master brand with a sharpened brand story and value proposition

- Manage risk by communicating to all stakeholders

When it comes to cutting costs, growing earnings, or improving operations, private equity firms can unlock exceptional value by better managing brands in their investments.